The cryptocurrency boom in 2017 truly cemented the status of the cryptocurrency market as the most intriguing market in tech. One of the main reasons for the intrigue is due to the size of the market, even in its infancy and the fact that cryptocurrencies and blockchain technology have a large number of use-cases, increasing their potential and their profitability.

This has led to some of the most recognizable brands on the planet becoming involved, or, planning to become involved in the cryptocurrency revolution in some manner. For example, JP Morgan has recently been developing their own digital currency, that they will begin offering to their corporate clients and the British bank, Barclays has been known to apply for patents relating to cryptocurrencies and blockchain technology.

One bank in Liechtenstein truly made a masterful move by venturing into the cryptocurrency market, offering to supply cryptocurrencies directly to their customers and despite the risk of hackers compromising customers, this bank is also promising protections against this eventuality. In this article, we will be exploring this bank and their decision.

Bank Frick Cryptocurrency Sales and Storage

Bank Frick is a private bank, situated in the Central European principality of Liechtenstein. The financial institution was founded in 1998 and is currently headquartered in the area named Balzers. In March 2018, the bank started offering its professional trader and financial consultant customers the option of purchasing different cryptocurrencies, directly from the bank. These cryptocurrencies are Bitcoin, Bitcoin Cash, Ether, Ripple ,Litecoin, Ethereum Classic, NEM, Qtum, and Stellar. This makes them the first bank in the principality to offer these types of services.

These individuals are permitted to make one transaction per day and these transactions are compatible with a number of different fiat currencies including, the US Dollar, the Swiss Franc, the Euro, and some others.

To provide their customers and their trading desk platform with more protection, Bank Frick stores their cryptocurrency reserves in “cold-storage” cryptocurrency wallets. Due to the fact that these wallets are not openly exposed to an internet connection, it eliminates the potential threat of losses from hacking. Furthermore, customers will not be required to have their own cryptocurrency wallet and will regularly receive reports on their cryptocurrency holdings from the bank.

The overall aim of Bank Frick’s new trading desk is to attempt to make crypto-banking as effective and easy as current traditional banking. In line with this and in the general interest of the platform, users will be subject to intensive know-your-customer checks.

Bank Frick’s Cryptocurrency Trading Platform

Bank Frick’s initial move of selling and storing cryptocurrencies has not waned their interest in the market, as they have also announced more recently in 2019 that they are creating their own subsidiary cryptocurrency trading platform that goes by the name DLT Markets. This platform is said to allow its institutional customers access to the multi-exchange digital asset class of tokens that is both secure and completely regulated.

The CEO of Bank Frick, Edi Wögerer had this to say in his statement. “With our spin-off, we are offering institutional clients a unique combination of a fintech company and a bank regulated by the EU.”

A previous member of Bank Frick’s business development section, Roger Wurzel has been selected as the CEO of the new venture, with blockchain developer and the co-founder of the cloud accounting firm Styxchange, heading up DLT Market’s business development team.

The Figures

The rise of Bank Frick is quite meteoric, having accelerated immensely in recent years. In a press release from April 2018, the bank made a statement claiming that they nearly doubled their total profits from 2016 to 2017, rising from $3.2 Million to $6.3 Million. Also at that time, the institution was responsible for the management of $3.8 Billion of client assets.

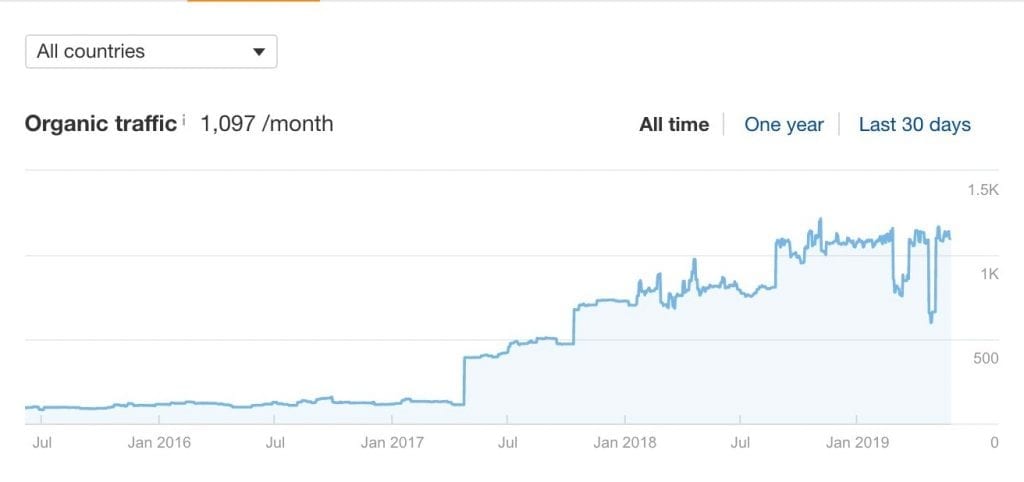

As can be seen in the figure below, organic traffic to the bank’s website was relatively low before they started to become involved in cryptocurrencies, never exceeding 200 and normally staying around 120 impressions from July 2015 to the end of 2017. Once the bank began to make it known that they were going to become involved with cryptocurrencies, traffic to their website and their exposure began to shoot through the roof, reaching a peak of around 1250 impressions per month.

This means that through the use of cryptocurrencies and by capitalizing on the cryptocurrency market, According to Aherf’s, Bank Frick has managed to increase its internet traffic to their site. This is an increase of over 900% of the figures that they were experiencing, pre-cryptocurrency.

Conclusion

Bank Frick managed to massively increase their online presence and caused their exposure to boom by over 900% following their entry into the cryptocurrency market. By being the first in their region to enter the market in this fashion, they have gained a massive headstart on their competition and have signaled to other institutions that it is entirely possible for a bank to attempt to integrate with the cryptocurrency market and have the move be profitable whilst being seen as positive.

If Bank Frick manages to get their cryptocurrency services to new heights despite being a relatively small bank, they will encourage other institutions, even smaller ones to begin offering their own cryptocurrency services, which will lead to wider adoption of blockchain technology amongst the banking sector. This could potentially remove some of the stigmas that banks hold against cryptocurrencies, putting a dent in a big barrier to the market.