Success So Far

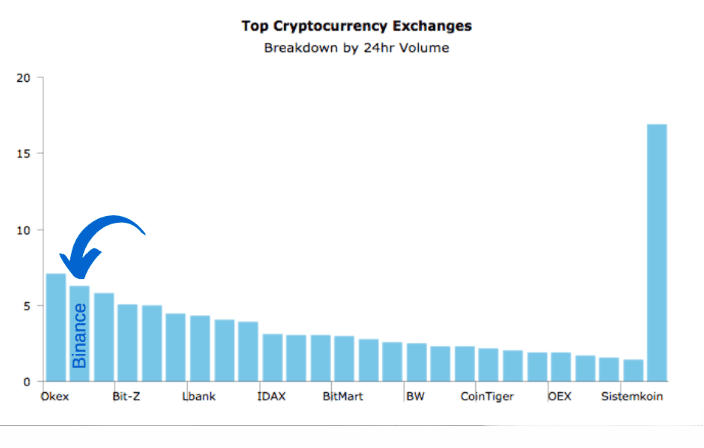

Currently ranked second-largest exchange in the world on Live Coin Watch, Binance has had a remarkable rise to success since its inception in 2017. It has since become a powerhouse platform for crypto investors of all sizes.

The company’s CEO, Changpeng “CZ” Zhao, recently celebrated a huge milestone for the platform’s native currency – a transaction of $1.2 billion worth of BNB across the Binance Chain, completed in 1.1 seconds, with a staggeringly nominal fee of just $0.015. The platform’s native token, BNB, is currently ranked the sixth-largest cryptocurrency on the market, with a market capitalization of $4.6 billion.

Earlier this year, the platform also launched it ‘Launchpad’ feature, which enables carefully selected crypto and blockchain projects to raise funds by exposing their offerings to Binance’s 10 million-plus user base. The initiative aims to supply blockchain startups with the necessary resources to successfully complete funding through initial coin offerings (ICO).

Binance has recently upgraded its site, and also introduced the ‘2.0′ version of its platform. Binance 2.0 is set to enable its verified customers to participate in margin trading across a plethora of cryptocurrency pairs.

Surpassing Big Banks

Although the company has recently experienced some setbacks, that hasn’t restricted them from becoming extremely profitable.

Binance’s current employee count tallies 300+ – a nominal figure for such a fast-growing organization.

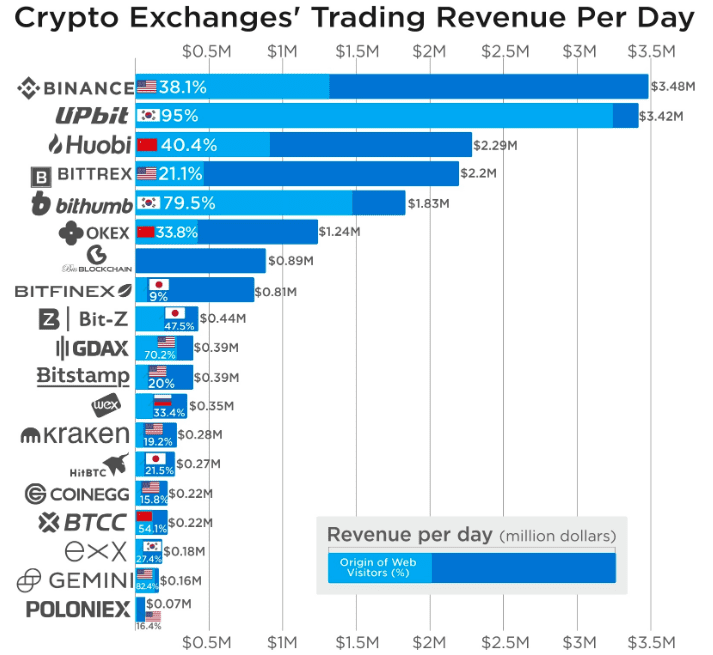

Now to their profitability. According to howmuch.net, Binance has been leading the way in terms of daily profits, turning over a cool $3.48 million every day. That equates to an average of $1.27 billion per year.

These figures show that Binance’s return per employee (RPE) is a colossal $3.62 million. As far as the statistics show, big banks and other major financial institutions could only dream about these numbers.

Swiss banking giant, UBS, was leading the way amongst its European competitors back in 2017, pulling in an RPE of over €449,000, followed by UK-based Lloyds, who generated an RPE of €278,100. Although these organizations are well-established, they are still way behind Binance.

The world’s second-largest crypto exchange continues to overshadow world-renowned financial investment banking giants such as J.P. Morgan. In 2018, J.P. Morgan declared an employee count of over 256,000, who were able to generate the organization $6.9 billion. This calculates to an RPE of just under $27,000.

These figures appear to show that even the mightiest of banking institutions aren’t able to scale anywhere near the pace of Binance. However, this is just the beginning for the Japan-based crypto exchange.

Just The Beginning For Binance

After just two years in business, Binance is sure to become one of the largest entities within the crypto trading world, with its 2.0 platform hot off the press, its margin trading functionality, and the launch of it guided ICO “Launchpad” service.

Although the company is still in its infancy, the growth of the Binance brand isn’t slowing any time soon. The organization is also set to activate cryptocurrency futures contracts soon, which could prove to be a huge move for the crypto community. The company has also initiated various charity projects and has also added a research and analysis arm to its operations, showing that they’re not shy of rapid expansion in many different sectors.