Facebook libra is the latest high profile blockchain project clashing with US regulators who are pressing for development to halt. Lawmakers have continually pressed the tech firm and it’s subsidiary Calibra to freeze cryptocurrency development during hearings in July.

Calibra CEO David Marcus agrees that Libra will not launch until regulators were happy but development will seemingly continue.

Large numbers of cryptocurrency and blockchain companies have been deserting their Stateside operations in recent years. Many claim it is down to confused antiquated legislation and slow response from government regulators.

The Facebook Libra case is a clear example of the troubles all blockchain startups face. Projects sweat in limbo by unclear regulation and lack thereof it. Add to this mixed state rules, such as the New York BitLicense, and many companies are saying no thanks.

It is a troubling issue for the US tech industry which is being left behind. The Land of Opportunity is fast becoming the Land of Missed Opportunity for organizations and citizens.

Problems push far beyond blockchain startups with established industry leaders removing their American markets.

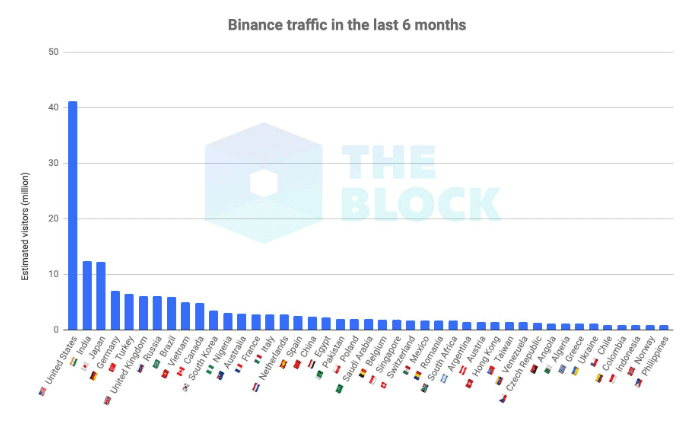

In June, Binance joined the growing list of cryptocurrency platforms that will kill its US service. The leading trading exchange’s abandonment is planned for September with terms and conditions stating “is unable to provide services to any U.S. person.”

A huge blow to the company who’s largest client base is North America but CEO of Binance, Changpeng Zhao, was a little more optimistic on Twitter “Some short term pains may be necessary for long term gains. And we always work hard to turn every short term pain into a long term gain.”

Binance accompanies Poloniex, Bittrex, Bancor and Bitfinex in ringfencing part or all of its service to US customers via geoblocking. With favorable laws elsewhere blockchain startups may be abandoning the Land of Opportunity for a World of Opportunity.

The U.S. Losing out to Switzerland

If the big players are rejecting the country then it is a major problem for new startups. The SEC stance in classing tokens as securities coupled with other unclear regulation is leading to avoidance. Lawyers continue advising startups not to issue tokens, ICOs or even reside in the US.

Decentralized ledgers generally need a token system to function efficiently. Classing all tokens as securities put blockchain companies on the regulatory hook.

If you listen to the hardest crypto libertarians then you could be forgiven for thinking that any regulation makes the industry cringe. For the United States, it is not that thought of regulation rather its the Band-Aid application.

Rulings continually create unclear confusing regulation. Arguments of classing tokens under securities legislation. Slow and uninformed reaction to new technology. All are turning businesses away.

Regulators are trying to apply centuries-old antiquated framework to an evolving tech economy. This also leads to crypto to fiat banking issues that hinder many companies discussed. Laws are more restrictive rather than helpful with governments becoming fearful of bitcoin. It is becoming clear there is little way to shut these operations down potentially leading to kneejerk reactions.

“There’s no question that the current regulatory approach to crypto in the U.S. breeds uncertainty and could harm innovation. We have advocated for a clear, forward-looking regulatory framework so the U.S. can realize the full potential of crypto and blockchain technologies. That advocacy will continue and will ramp up, especially now that Facebook’s Libra is causing many to reckon with crypto for the first time.” discussed Gus Coldebella, chief legal officer at Circle.

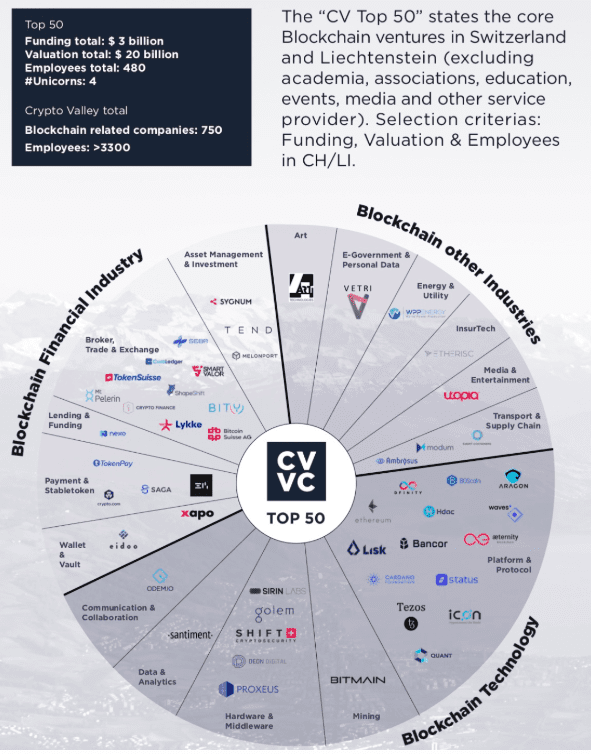

Countries such as Switzerland are known for favorable banking rules and some see the same freedom with cryptocurrencies. A particular coup is a 2018 decision that not all tokens are securities.

“We feel that this approach best represents the principle of technological neutrality and is in line with the position taken by the Crypto Valley Association (CVA) in the consultation process,” explains CVA spokesman Mattia Rattaggi.

An eyewatering selection of blockchain giants domicile protected amongst Swiss mountains including Ethereum, Xapo, Tezos, Bancor, and Cardano. Across Switzerland and Lichstestien alone there are over 700 blockchain ventures encompassing all areas of the industry from finance, to media, to supply chain solutions.

Future regulation

The current situation is no doubt a bleak one but green shoots are appearing to start applying pressure to congress.

Congressman Warren Davidson is a particular shining light for crypto enthusiasts having introduced the Token Taxonomy Act (TTA) to committee in April 2019. TTA proposes amendments to the Securities Act 1933 and Securities Exchange Act 1934.

Blockchain and cryptocurrency startups will welcome the proposed bill as it looks to remove tokens as a security. Furthermore, it adds certain regulation to digital assets acquired via public-key cryptography and tax exemptions on crypto to crypto trades.

“The Token Taxonomy Act is the key to opening up blockchain technology in America. Without it, we’re left with more bureaucratic jargon that creates chaos and confusion instead of the certainty that markets need to flourish and thrive.” Clarifies Davidson on Twitter.

His bill is still in its early stages as it is under consideration by the committee before any chance of entering the house or senate. There is still a huge journey before getting anywhere near the presidents signature. Skyposlabs puts just a 4% chance of the bill being passed so a turbulent time still remains ahead for the US blockchain and cryptocurrency industry.